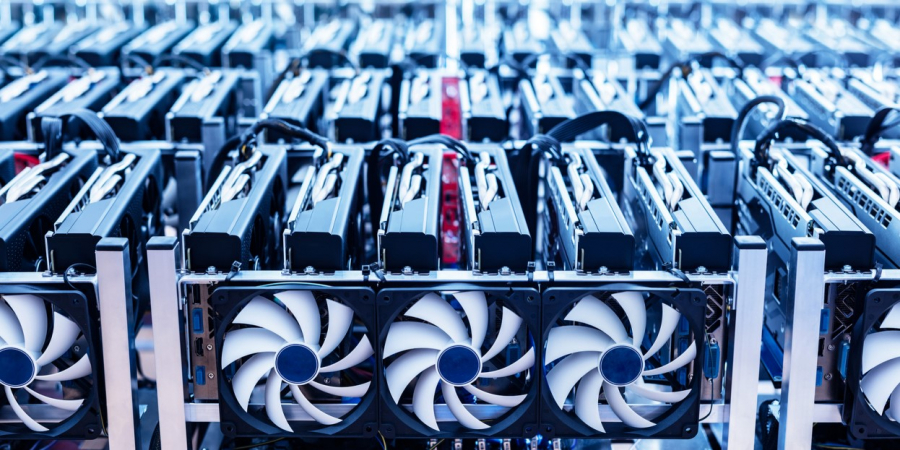

Cryptocurrency miners in Kazakhstan will pay more tax to the budget. But before it is increased, it is planned to develop a full-fledged package of solutions for the regulation and development of digital mining. In addition, all mining farms in the country will be identified and checked. As President Kassym-Jomart Tokayev noted at a recent expanded meeting of the Government, the current rate - one tenge per kilowatt of power - is negligible. In the country, illegal crypto farms consume more than 1.4 gigawatt of electricity, which is two times more than officially operating miners use.

“The tax rate in Kazakhstan that is in fact charged, in general, is one of the lowest. Our tax base is much lower than in Russia, for example. They have 20 percent VAT, we have 19 percent. There's a difference. Even for individuals, the individual income tax there is 13 percent, ours is 10. So, in many ways, with the current tax systems, it is much more profitable for them to be here than in say America or Europe. According to the President, the new tariffs and tax rates need to be tightened, that is, tax revenues should be increased by raising rates. This may scare away mining companies, they can take their business elsewhere, if it will become unprofitable for them to stay in Kazakhstan,” said Arman Baiganov, an economist.

Kazakhstan has lately been one of the world leaders in mining cryptocurrencies. So, in August of last year, the country ranked second in the world – 18 percent of the global mining volume - after the United States. Russia is coming third.

Translation by Aruzhan Bizhigitova

Editing by Galiya Khassenkhanova